Traditional Risk Registers Are Broken: Here’s How FAIR Can Fix Them

In the evolving world of risk management, the humble risk register remains a foundational tool. However, not all risk registers are created equal. Traditional risk registers often focus on listing and categorizing risks qualitatively, while those based on the FAIR (Factor Analysis of Information Risk) model bring a new and necessary level of precision and business alignment to the process. In this blog post, we explore the key differences between these two approaches and the transformative value of a FAIR-aligned risk register.

Author Nick Sanna is Founder of the FAIR Institute

What Is a Risk Register?

A risk register is a structured document or tool used to identify, analyze, and manage risks. Its purpose is to serve as a central repository, enabling organizations to track potential threats, assess their impacts, and prioritize mitigation efforts. While this definition applies broadly, the methods used to populate and maintain a risk register can vary dramatically depending on the framework applied.

The Traditional Risk Register

Traditional risk registers typically adopt a qualitative approach, where risks are assessed and categorized based on subjective criteria. Key characteristics of traditional risk registers include:

1. Qualitative Assessment: Risks are often rated as "High," "Medium," or "Low" based on subjective evaluations of likelihood and impact.

2. Generalized Descriptions: Risks are described in broad terms, lacking specificity around the scenario or context.

3. Limited Metrics: Metrics are often arbitrary or vague, relying on ordinal scales like 1-5 rather than objective and measurable values.

4. Static Nature: Updates are infrequent and may not reflect evolving risk conditions or changing business priorities.

5. Lack of Business Alignment: Risks are typically not quantified in financial terms, making it difficult for stakeholders to see their direct impact on business objectives.

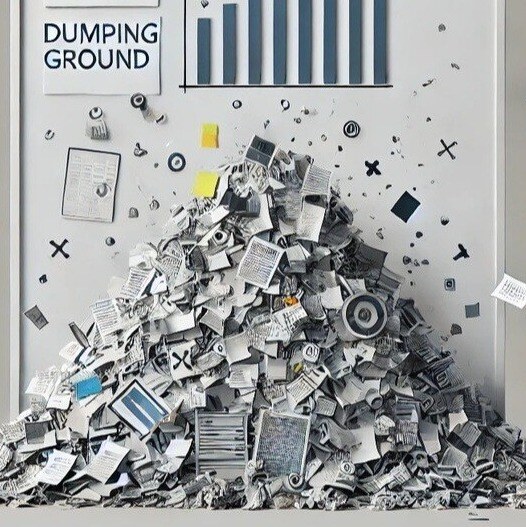

Traditional risk registers often fail because they become dumping grounds for anything that appears “risky.” Loose descriptions lead to entries that don’t represent actual risks. Based on our experience with customers, up to 90% of entries in traditional risk registers describe control gaps, vulnerabilities, threats, or assets—components of risk, but not risk scenarios themselves.

This misclassification bloats risk registers with irrelevant entries, relies on subjective measurements, and misprioritizes the organization's real challenges. As a result, these registers fail to provide valuable insights for decision-making and instead highlight the shortcomings of the overall risk management program.

The FAIR-Aligned Risk Register

The FAIR model elevates the risk register by introducing a quantitative, business-oriented perspective. Here’s how a FAIR-aligned risk register stands apart:

1. Quantitative Analysis:- Risks are measured in financial terms, such as potential loss in dollars, enabling clear prioritization

- Metrics like Annualized Loss Expectancy (ALE) provide a concrete view of the risk landscape.

2. Scenario-Based Precision:

- Risks are framed as specific scenarios, detailing the threat, asset, vulnerability, and potential loss event.

- For example, instead of "data breach," a FAIR register entry might state, "Unauthorized access to customer data via phishing attack by cyber criminals."

- The quantitative nature of FAIR provides defensible, data-driven insights that support resource allocation and mitigation strategies.

- It helps organizations focus on risks that have the greatest potential business impact.

- A FAIR-aligned risk register is not static; it evolves with changes in the threat landscape, control environments, and business objectives.

- Regular updates ensure relevance and accuracy.

- Risks are explicitly tied to organizational goals and risk appetite, enabling better communication with stakeholders and alignment with strategic priorities.

Comparing Traditional and FAIR-Aligned Risk Registers

|

Aspect |

Traditional Risk Register |

FAIR-Aligned Risk Register |

|

Assessment Approach |

Qualitative (High/Medium/Low) |

Quantitative (financial metrics like ALE) |

|

Risk Description |

Vague and inconsistently defined |

Scenario-based |

|

Metrics |

Subjective and arbitrary scales |

Objective, data-driven metrics |

|

Business Relevance |

Limited alignment with business goals |

Strong alignment with business objectives |

|

Updates |

Infrequent |

Dynamic and continuous |

|

Insights |

Broad, less actionable |

Specific, actionable, and defensible |

|

Prioritization |

Subjective rankings |

Based on quantified impact and cost-benefit analysis |

|

Stakeholder Communication |

Difficult to communicate risk to non-technical stakeholders |

Enables clear, business-oriented communication |

Why Choose a FAIR-Aligned Risk Register?

Adopting a FAIR-aligned risk register transforms risk management into a strategic, business-driven discipline. Here are the key benefits:

1. Clarity: By quantifying risks in financial terms, organizations can clearly see the potential impact of risks on business outcomes.

2. Prioritization: FAIR’s data-driven approach ensures that efforts are focused on the most significant risks, optimizing resource allocation.

3. Defensibility: The structured, repeatable methodology of FAIR provides transparency and defensibility for risk decisions.

4. Improved Communication: Financial metrics and scenario-based risk descriptions resonate more effectively with executives and stakeholders.

5. Proactive Management: Continuous updates allow organizations to stay ahead of emerging threats and adapt to changing conditions.

Final Thoughts

While traditional risk registers serve as a foundational tool for tracking risks, they often fall short in delivering the insights needed for modern, dynamic risk environments. A FAIR-aligned risk register bridges this gap, offering a powerful, quantitative approach that aligns risk management with business objectives and delivers actionable insights.

As the complexity and stakes of risk management continue to rise, transitioning to a FAIR-aligned risk register can empower organizations to make smarter, more informed decisions and ensure resilience in the face of uncertainty.

Ready to take your risk register to the next level? Take a FAIR course and get your risk management program on solid footing.