Enhancing the Three Lines of Defense in Risk Management with FAIR Risk Analysis (Part 1: First & Second Lines)

In the world of risk management, the traditional Three Lines of Defense model has been widely adopted to mitigate and manage risks effectively. However, many organizations are still grappling with the process of communication and cooperation across these lines of defense in risk management.

In the world of risk management, the traditional Three Lines of Defense model has been widely adopted to mitigate and manage risks effectively. However, many organizations are still grappling with the process of communication and cooperation across these lines of defense in risk management.

This two-part blog series will explore the roles and capabilities of the first, second, and third lines of defense and how they intersect with cyber risk quantification (CRQ) analysis, using the Factor Analysis of Information Risk (FAIR™) standard model.

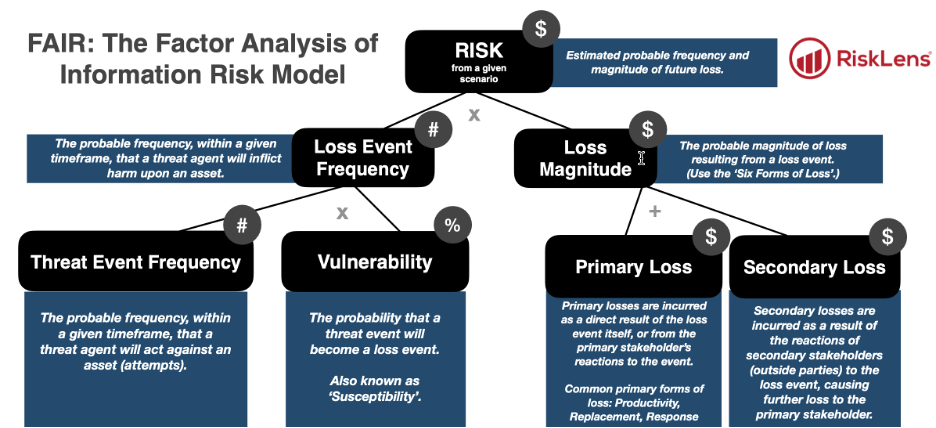

In this first part, we will describe the FAIR model and what data inputs can be provided by the first and second lines of defense as inputs to a FAIR analysis, as well as highlighting how they can benefit from FAIR analysis in the risk quantification process.

Understanding the FAIR Model for Quantifying Risk

The FAIR model is an international standard for quantitative cyber and operational risk analysis. It focuses on quantifying risk in terms of potential loss exposure (i.e., in terms of dollars and cents), enabling clear communication and decision-making among stakeholders. A FAIR analysis involves scoping scenarios that consider the following elements:

|

Defining a scenario requires a: |

Definitions and Example(s): |

|

Threat |

Anything, actor or agent, capable of harming an asset in a manner that can result in loss |

|

Loss Effect |

The outcome(s) of threats leveraging methods against assets e.g., Confidentiality: sensitive, non-public information is inappropriately disclosed Availability: asset(s) are unavailable for use Integrity: information is either incomplete or inaccurate |

|

Asset |

Anything of value that can be negatively affected such that loss could materialize (e.g., crown jewel database, source code, etc.) |

|

Method (Optional) |

A form of action a threat uses to negatively affect the state of an asset, leading to a loss event |

At a High Level, How the FAIR Model Quantifies Risk

The First and Second Lines of Defense and FAIR Quantitative Risk Analysis

The first line of defense in risk, operational management, is responsible for identifying, assessing, and managing risks associated with day-to-day operations. The second line of defense, risk management and compliance teams, provides oversight of emerging risks and ensures that the organization complies with relevant laws, regulations, and standards. By leveraging FAIR analysis, both lines of defense in risk management can gain a clearer understanding of the organization's risk landscape, prioritize risks more effectively, and make better-informed decisions.

How the First and Second Lines of Defense Contribute to FAIR Analysis Metrics

· First Line: Operational Management

o Threat Event Frequency: Operational management teams can provide historical data on the occurrence of threat events, such as security incidents, system failures, or human errors from the SOC (security operations center), or similar group. This data is crucial for determining the frequency of threats faced by the organization.

o Loss Event Frequency: Operational management teams can share information on the number of times loss events have occurred due to threat events, which helps estimate the likelihood of loss events occurring in the future.

o Vulnerability: Operational teams can provide insights into the effectiveness of controls and mitigation strategies in place to prevent or minimize the impact of threat events, which helps assess the organization's vulnerability.

o Loss Magnitude: Operational management teams can offer data on the financial, operational, or reputational impact of previous loss events, which can be used to estimate potential loss magnitudes.

· Second Line: Risk Management & Compliance Teams

o Threat Event Frequency: Risk management teams can contribute intelligence on emerging risks, trends, and threat actors in the industry or regulatory environment, helping to assess the likelihood of threat events.

o Loss Event Frequency: Compliance teams can provide information on the organization's compliance track record, including the number of incidents resulting from non-compliance, which can influence the loss event frequency.

o Vulnerability: Risk management and compliance teams can evaluate the adequacy and effectiveness of existing risk mitigation measures and controls, providing valuable insights into the organization's vulnerability.

o Loss Magnitude: Risk management teams can offer data on potential losses stemming from identified risks, considering factors like regulatory fines, legal costs, or business disruptions.

Benefits of FAIR Analysis for the First and Second Lines in Risk Management

-

Improved risk prioritization and decision-making: FAIR analysis enables both lines to prioritize risks based on their potential impact and allocate resources accordingly. By focusing on risks with the greatest potential consequences, operational teams and risk management teams can better support the organization's strategic objectives.

-

Standardized language and metrics: A standardized approach to risk assessment, using the same language and metrics, promotes better alignment and collaboration between the first and second lines of defense. This enables more effective communication and fosters a shared understanding of the organization's risk landscape.

-

Enhanced transparency and accountability: The data-driven approach of the FAIR model promotes transparency and accountability across the organization. By adopting a standardized approach to risk assessment, the first and second lines can demonstrate to stakeholders that the organization is taking a robust and consistent approach to risk management.

-

Continuous improvement: The adoption of the FAIR model encourages a continuous improvement mindset within both lines of defense. As they gain a better understanding of the organization's risk landscape through FAIR analysis, they can identify areas of improvement and refine their risk management processes.

Learn more:

What Is Cyber Risk Quantification (CRQ) and How Does It Help Risk Management Decisions?

Mapping FAIR-CAM to Cybersecurity Frameworks: ‘Compliance Is Going to Radically Change’

Part 1 Conclusion: Enhancing the 3 Lines of Defense with FAIR

In conclusion, the adoption of the FAIR model in risk quantification significantly enhances the effectiveness and alignment of the first and second lines of defense. By integrating FAIR analysis into their risk assessment approach, operational management and risk management & compliance teams can improve risk prioritization, decision-making, and collaboration. This ultimately results in a more efficient and effective risk management process within the organization.

Coming next in the series: Enhancing the Third Line (Audit) with FAIR Analysis

Author Michael Smilanich is a Risk Consultant with RiskLens, the risk management and risk measurement application purpose built on the FAIR model.

Author Michael Smilanich is a Risk Consultant with RiskLens, the risk management and risk measurement application purpose built on the FAIR model.