Cybersecurity leaders face an increasingly complex risk landscape where the stakes—financial, operational, and regulatory—continue to climb. The FAIR Institute’s latest white paper, A FAIR Framework for Effective Cyber Risk Management, written by Pankaj Goyal, Institute Director of Standards and Research, and me, provides an invaluable blueprint for addressing these challenges.

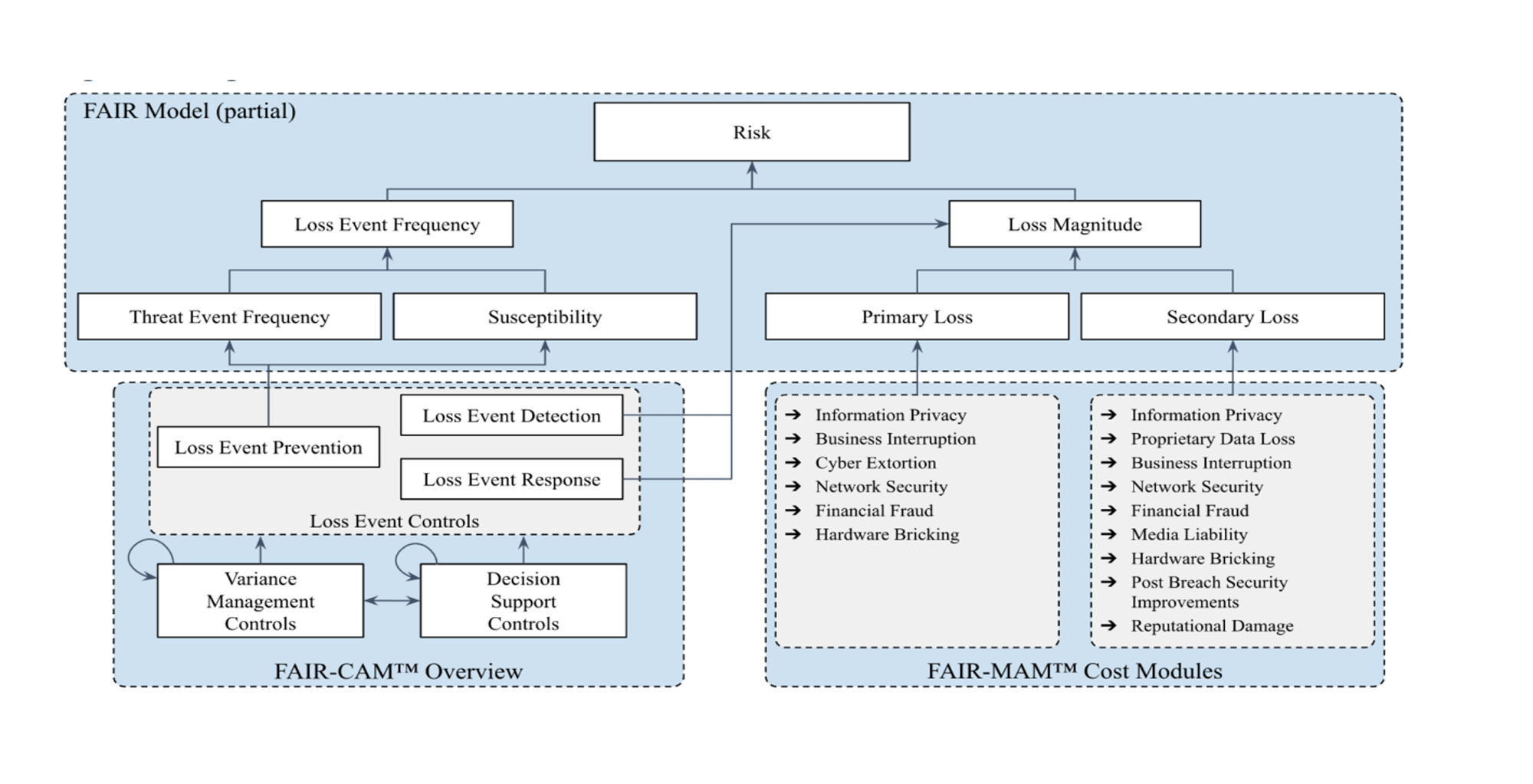

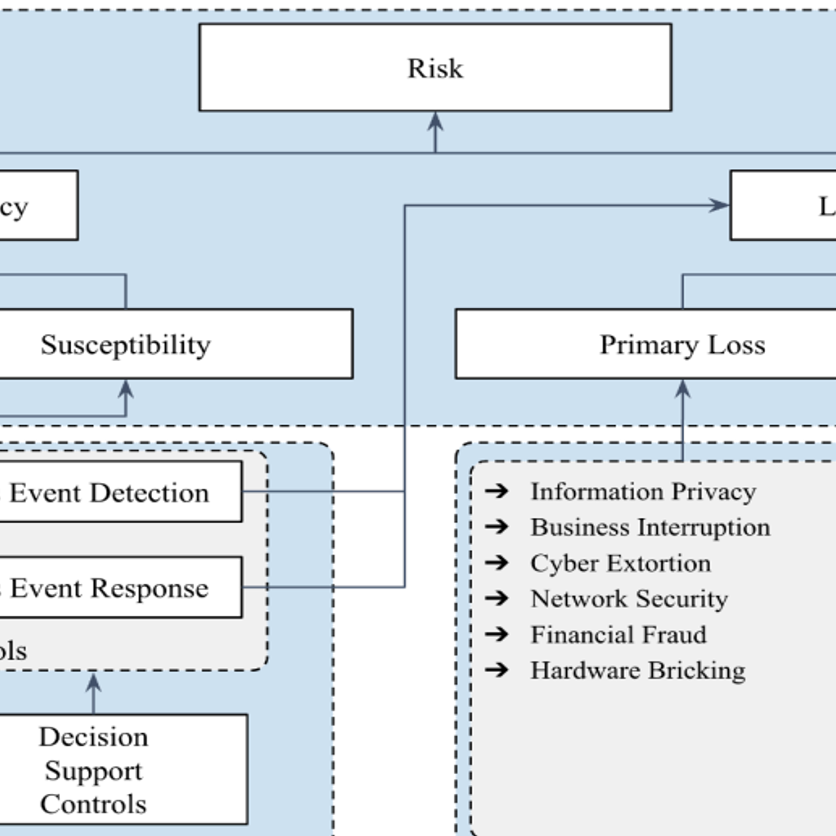

By detailing the integration of the FAIR Model, FAIR Controls Analytics Model (FAIR-CAM), and FAIR Materiality Assessment Model (FAIR-MAM), this paper illustrates a robust framework that quantifies cyber risk in financial terms while aligning security practices with business objectives.

Author Todd Tucker is Managing Director, FAIR Institute

This paper was developed to bridge a gap in how organizations quantify and manage cyber risks. Many existing approaches to cybersecurity focus on improving controls (mitigating vulnerabilities) without a clear understanding of the broader impact on business operations or compliance mandates.

Furthermore, the 2023 SEC Cybersecurity Disclosure Rule in the US and the NIS2 Directive in Europe have heightened the need for transparent, standardized methods for reporting material risks and estimating potential losses.

By weaving together three interrelated FAIR standards, this paper sets out to empower Chief Information Security Officers (CISOs), cyber risk leaders, and other stakeholders to:

- quantify risk in terms of probable financial loss, taking into account control effectiveness and its direct impact on risk factors;

- evaluate materiality with a structured, defensible approach to loss estimation; and

- align risk management efforts, especially investments to improve controls, with business priorities and regulatory compliance.

From the White Paper, A FAIR Framework for Effective Cyber Risk Management

For CISOs and cyber risk management leaders, this white paper addresses how to:

- Bridge the Cyber-Business Gap: By quantifying risk in financial terms, the integrated FAIR models enable leaders to communicate risk in a language the board and executives understand—dollars and cents.

- Optimize Control Effectiveness: FAIR-CAM offers a structured methodology for understanding how controls interact as a system, allowing organizations to invest strategically in the most impactful controls.

- Meet Regulatory Demands: With the SEC’s requirement to disclose “material” risks, FAIR-MAM provides the granularity and rigor needed to develop accurate and defensible loss estimates for reporting.

- Enhance Decision-Making: By integrating these models into a Cyber Risk Management System (CRMS), organizations gain real-time insights (situational awareness), enabling better prioritization and resource allocation.

Our paper addresses the following key topics:

- The FAIR Model: Foundation for Risk Quantification

At its core, the FAIR Model decomposes risk into Loss Event Frequency and Loss Magnitude, providing a clear structure for estimating annualized loss exposure (ALE). By integrating threat intelligence and vulnerability data, FAIR enables dynamic, continuous risk monitoring. - FAIR-CAM: A “Controls Physiology” Approach

FAIR-CAM expands on the FAIR Model by categorizing controls into three domains — Loss Event Controls (reduce loss frequency or magnitude), Variance Management Controls (ensure control reliability), and Decision Support Controls (align decisions with organizational objectives). This systemic perspective highlights interdependencies between controls, ensuring a more reliable measurement of their effectiveness. - FAIR-MAM: Granular Loss Magnitude Analysis

FAIR-MAM addresses the challenge of quantifying the financial impact of cyber incidents. By breaking down losses into 10 modules and 26 categories, it enables analysts to provide more precise, defensible estimates. This is particularly valuable for meeting regulatory reporting requirements like those outlined by the SEC. - Role of the Cyber Risk Management System (CRMS)

A CRMS operationalizes these FAIR standards by centralizing data, automating analyses, and enabling real-time monitoring. It provides a unified platform for integrating risk quantification, control evaluation, and loss analysis, ensuring decisions are both data-driven and aligned with business goals.

Conclusion

This white paper serves as an essential guide for organizations seeking to implement cyber risk management at scale using FAIR. By integrating the FAIR Model, FAIR-CAM, and FAIR-MAM, organizations can shift from reactive, siloed security measures to proactive, aligned risk management strategies.

For cyber risk leaders navigating an increasingly complex threat landscape, this framework offers not just a roadmap but a competitive advantage—demonstrating resilience, transparency, and strategic alignment in the face of growing cyber challenges.