Is FAIR relevant to board members or only the teams that get their hands dirty in cybersecurity?

FAIR is the only international standard for quantitative information risk analysis. Unlike traditional qualitative approaches that rely on subjective heat maps or vague high/medium/low risk ratings, FAIR (Factor Analysis of Information Risk) enables organizations to quantify risks in the financial terms that best serve effective business management.

Bernadette Dunn is Head of Executive Education and Training for the FAIR Institute

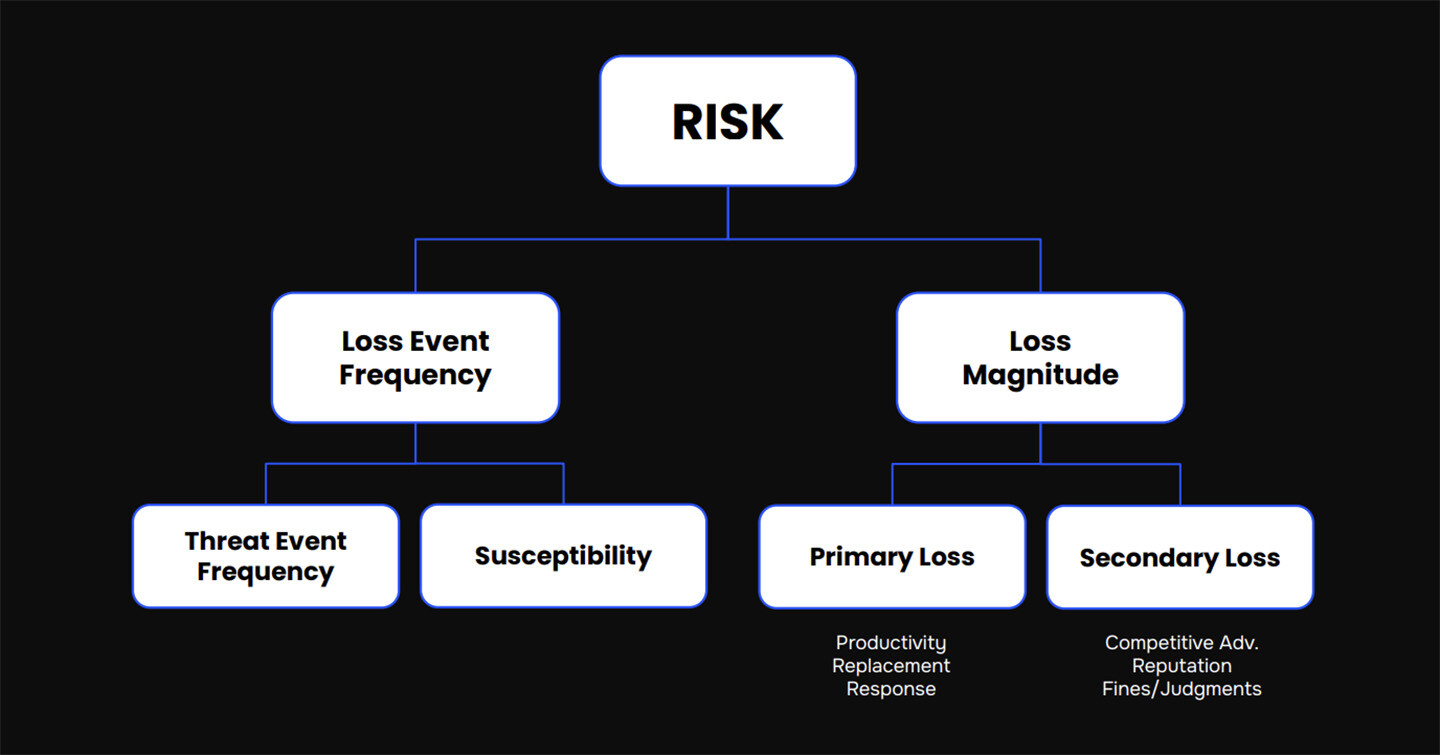

High level view of the FAIR model

FAIR has become the go-to methodology for CIOs, CISOs, cyber risk managers, and front-line cybersecurity operators to get fast, reliable guidance on tactical decisions such as

>>Prioritizing among risks for remediation based on return on investment

>>Evaluating the effectiveness of cybersecurity controls and processes based on measurable risk reduction

>>Coming to a quick understanding on the materiality of a cyber loss event in financial terms

The Case for Board Education on FAIR

Board members operate at a higher level; their duty is not risk management but risk oversight, assuring themselves, their investors and regulators that the organization is performing due diligence on risk (and for regulated companies, identifying and disclosing incidents of material impact on the corporation).

But we would argue that in fact, knowledge of FAIR should be on the education agenda for every board director.

FAIR’s greatest strength lies in its capacity to demystify cyber risks for non-technical stakeholders by framing them in financial terms. By leveraging FAIR, board members can gain the clarity and confidence to contribute meaningfully to cybersecurity discussions without needing extensive technical expertise. FAIR empowers board directors to communicate and compare cyber risks on the same strategic level as other enterprise risks, such as financial, operational, legal, or strategic risk.

So we’d call FAIR the missing link between cybersecurity and business strategy that all board members need to understand. And the trends in corporate governance are lining up that way.

The Shift in Cyber Risk Governance

Over the last decade, cyber risks have rapidly evolved from a technical issue to a core strategic concern. Regulators, investors, and stakeholders now expect board directors to provide robust oversight of their organization’s cybersecurity strategy.

The National Association of Corporate Directors (NACD) Cyber-Risk Oversight Handbook urges directors to deeply educate themselves on cybersecurity at the corporate governance level. The handbook recommends that directors ask probing questions of management, such as

The National Association of Corporate Directors (NACD) Cyber-Risk Oversight Handbook urges directors to deeply educate themselves on cybersecurity at the corporate governance level. The handbook recommends that directors ask probing questions of management, such as

“How are we measuring the threat environment?”

“What is our cyber risk profile?”

“What is our cyber risk exposure in economic terms?”

“Are we making defensible business and operational decisions in terms of cyber risk?”

“How do we benchmark against our peers in cybersecurity?”

Disclosure of material cyber risks and incidents is now under stricter scrutiny from regulators – see the US SEC's 2023 rules that demand explicit disclosure of the processes that boards follow in overseeing management’s risk programs, and the European Digital Operations Resiliency Act (DORA) requirements that board members be schooled in cyber risk.

This growing emphasis on board-level cybersecurity oversight highlights the need for a structured approach to assess, prioritize, and communicate these risks. This is where the FAIR Model provides unparalleled value.

Key Values that Make FAIR Critical to the Board Director’s Risk Oversight Role

Quantification in business terms

At its core, FAIR is built on the principle of breaking down risk into two critical, measurable components:

>>Frequency of Loss Events – How often could this bad thing happen to us?

>>Magnitude of Loss – How much will it cost us if it happens?

In other words, FAIR quantifies the two key variables that business decision-makers must weigh regarding risk.

Quantification that's trustworthy and transparent

Trusted: The FAIR model has been recommended for cyber risk analysis by the National Institute of Standards and Technology Cybersecurity Framework (NIST CSF), ISACA’s Reporting Cyber Risk to the Board of Directors guidance and other authorities.

Transparent: FAIR is an open standard, meaning no proprietary formulas that are closed to inspection. The data fed into the model comes from the organization’s internal reporting or respected sources of industry data such the Verizon Data Breach Investigations Report.

Modeling that answers the board’s questions

FAIR risk analysis models very specific risk scenarios based on real-world incidents, adapted to your organization. When aggregated to a strategic level, this approach, built from the ground up, assures a solid foundation, for instance, to gauge risk to a critical asset or business service. It also gives the flexibility to answer the what-if questions the board most often asks management: What if we are attacked in the same way our competitors just got hacked…What if we expand our attack surface by an acquisition…What if we invest in multi-factor authentication…What are the quantified effects on our loss exposure?

As a result, reporting on cyber risk is lifted to the level of reporting that boards know best. As the ISACA report states, “The more a risk-management measurement resembles the financial statements and income projections that the board typically sees, the easier it is for board members to manage cybersecurity risk.”

5 Reasons Why Board Members Should Learn FAIR

1. Align Cybersecurity with Business Strategy

One of the most significant challenges boards face is evaluating whether technical cyber risk assessments generated by management are being translated into actionable business insights. FAIR bridges this gap by enabling board members to judge if cyber risk management aligns with overall business strategy.

For instance, a board equipped with FAIR knowledge can most effectively fulfill its responsibility to approve risk appetite by better questioning whether the company has sufficient resources to bring risk down to an acceptable level.

2. Provide Effective Oversight of Cyber Risks

FAIR gives boards the tools to ask more meaningful, data-driven questions during cybersecurity discussions with management These include critical questions such as:

>>What is the potential financial impact of this identified risk?

>>Which cyber risks pose the greatest threat to our business strategy?

>>How does our cyber risk exposure measure against peer organizations or industry benchmarks?

Two key functions of the board oversight regarding cyber risk are:

>>Approving a risk appetite.

>>Determining the level at which loss exposure becomes material

Both are exercises in risk quantification, and board directors should demand that management provide defensible analytics to make those calls.

By reframing cybersecurity discussions in financial terms, board members can ensure that their oversight responsibilities are effectively fulfilled.

3. Stay Ahead of Regulatory Compliance

With increased scrutiny from regulators, a strong understanding of the FAIR Framework equips boards to meet compliance obligations proactively. FAIR provides a straightforward way to demonstrate cyber resilience to investors and regulatory bodies while making disclosures about risk factors more transparent and defensible.

4. Manage Fiduciary Liability

Board members have a fiduciary duty to act in the best interest of their shareholders and organization. Mismanaging or underestimating cyber risks can expose boards to significant liability. While boards have not been held liable yet for a data breach (unsuccessful lawsuits were filed in the SolarWinds and Marriott breaches) courts and regulators have made it clear that they expect boards to enforce a serious level of governance in risk management, ensuring that written policies, escalation processes, risk assessments and effective controls are in effect. The ability to quantify and prioritize risks using FAIR allows directors to oversee risk-based policies and procedures that stand up to legal and shareholder scrutiny.

5. Foster a Risk-Aware Culture

Board members who champion the adoption of FAIR are better positioned to foster a culture of cybersecurity awareness across the enterprise. By encouraging financial quantification of risks, and leading by example,boards can promote transparency, accountability, and informed decision-making at every level of the organization.

Educational Opportunity for Board Members on FAIR

To help board directors and senior executives gain a comprehensive understanding of FAIR, we are offering an exclusive educational course tailored to meet their needs.

Course Highlights

This course is designed to address the challenges of overseeing cyber risks at the board level and equip participants with actionable knowledge. Key topics include:

- Cyber Risk and Business Strategy – Learn how to integrate cyber risk into strategic decision-making.

- Regulatory Considerations – Navigate compliance requirements with confidence.

- Critical Questions for Board Oversight – Ensure your board discussions focus on measurable outcomes.

- Real-World Examples – Gain insights from businesses that successfully tackled cyber risks.

- Creating a Cyber-Aware Culture – Advocate for a culture where cybersecurity is a shared responsibility.

By the end of this course, you’ll be ready to transform how your board perceives and manages cyber risks, turning them from technical challenges into strategic opportunities.

Who Should Attend?

This course is perfect for:

- Board Members seeking to enhance their understanding of cyber risk.

- Senior Executives addressing cyber risks in their strategic decisions.

- Audit Committees evaluating cybersecurity reports.

Register now for the course “Understanding Cyber Risk Reporting with FAIR” on either of these platforms: