The FAIR Institute's FAIR-CAM™ User Workgroup is an incubator for practical use cases in applying FAIR-CAM™ as a Diagnostic Tool to expose the root cause of control variance and decision gaps. These insights are used to inform the uplift in the design of Loss Event Controls. The workgroup is a supportive environment for members to work on and publish their research while being reviewed by Institute leaders. A deep understanding of these root causes is the foundation for automating risk management in emerging use cases, including embedding finance and embedding insurance. These important financial services supply chains in the information economy directly impact people's daily lives. The workgroup is chaired by Denny Wan, founder and co-chair of the FAIR Institute Sydney Chapter, provides an opportunity for members to connect, learn, and share their experiences on practical use cases in applying FAIR-CAM™.

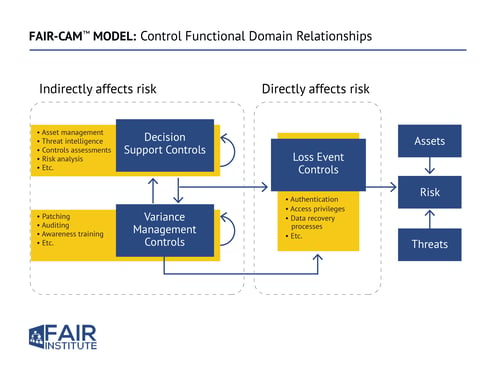

The FAIR-CAM™ controls model was created by Jack Jones, the author of Factor Analysis of Information Risk (FAIR), the international standard for quantification of cyber and technology risk. The FAIR-CAM™ model is an extension of the FAIR standard that documents how controls physiology functions by describing how controls affect the frequency and magnitude of loss events. The FAIR-CAM™ model accounts for controls both with direct and indirect effects on risk, yielding a complete system view.

|

The FAIR Controls Analytics Model™ (FAIR-CAM™) control “physiology”:

|

|

The goal of this workgroup is to study and develop use cases as an efficient way to learn about this revolutionary approach to cyber risk management and contribute to the further development of the model. The workgroup is a supportive environment for members to work on and publish their research while being reviewed by Institute leaders.

**Must be an active Contributing Member to Join**

Members of the FAIR Institute take advantage of many benefits. The greatest benefit is access to the exclusive community of information risk officers, cyber security leaders and business executives who share their experience and knowledge on the growing discipline of information risk management.

Members also receive: