Enhancing the 3 Lines of Defense with FAIR Risk Analysis (Part 2: Third Line)

In the second part of our blog series, we will focus on the third line of defense, internal audit, the types of data it can provide to contribute to a FAIR risk, and how it can benefit from adopting FAIR analysis in the risk quantification process.

In the second part of our blog series, we will focus on the third line of defense, internal audit, the types of data it can provide to contribute to a FAIR risk, and how it can benefit from adopting FAIR analysis in the risk quantification process.

Read Part 1 in the series:

Enhancing the First and Second Lines of Defense with FAIR

The Third Line and FAIR Analysis

The third line of defense, internal audit, is responsible for providing objective and independent assurance on the effectiveness and integrity of the organization's risk management processes and controls. By leveraging FAIR analysis, internal audit teams can gain a clearer understanding of the organization's risk landscape and assess the effectiveness of the risk management efforts by the first and second lines of defense.

How The Third Line of Defense Can Contribute to FAIR Analysis Metrics:

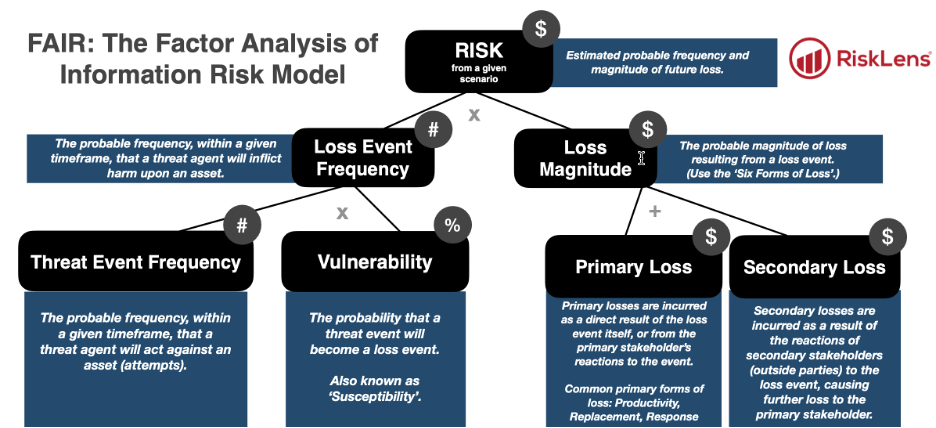

Threat Event Frequencyo Internal audit teams can provide an independent assessment of threat event frequency based on their audits of the organization's processes, systems, and controls.

o Loss Event Frequency: Internal audit can share findings on the frequency and causes of loss events identified during audit engagements, offering valuable insights into potential loss event patterns.

o Vulnerability: Internal audit teams can evaluate the design and operational effectiveness of controls in place, which helps assess the organization's vulnerability to threat events.

o Loss Magnitude: Internal audit can offer insights into the potential impact of risks on the organization's financial performance, operational efficiency, and reputation, based on their analysis of audit findings and control deficiencies.

Benefits of FAIR Analysis for the Third Line of Defense

-

Improved risk assessment: FAIR analysis allows the internal audit team to assess risks more accurately and objectively. By grounding their assessments in data-driven insights, audit teams can better identify areas of concern and evaluate the effectiveness of existing controls.

-

Better alignment with the first and second lines: A standardized approach to risk assessment, using the same language and metrics, promotes better alignment and collaboration between the internal audit team and the first and second lines of defense. This enables more effective communication and fosters a shared understanding of the organization's risk landscape.

-

Enhanced credibility and trust: The FAIR model's data-driven approach to risk quantification can help demonstrate to stakeholders that the organization is taking a robust and standardized approach to risk management. This can enhance the credibility and trust in the internal audit team's findings and recommendations.

-

Informed decision-making: The quantitative outputs from a FAIR analysis can help the internal audit team make more informed decisions about where to allocate resources and prioritize their efforts. By focusing on risks with the greatest potential impact, audit teams can better support the organization's strategic objectives.

Learn more:

How FAIR Helped Me Rethink 3 IT Audit Questions

3 Tips for Making Your IT Audit Job More than Compliance

Conclusion: Internal Audit and FAIR

In conclusion, the integration of FAIR analysis into the risk quantification process has notable benefits for the third line of defense, the internal audit team. By adopting a standardized, data-driven approach to risk assessment, internal audit teams can achieve more accurate risk assessments, improved decision-making, and better alignment with the first and second lines of defense. Overall, the adoption of the FAIR model fosters enhanced communication and collaboration among the three lines of defense, leading to a more robust and efficient risk management process across the organization.

Author Michael Smilanich is a Risk Consultant with RiskLens, the risk management and risk measurement application purpose built on the FAIR model.

Author Michael Smilanich is a Risk Consultant with RiskLens, the risk management and risk measurement application purpose built on the FAIR model.